In a recent Content4Demand webinar, Research Campaigns: Tell Stories With Data for “Campaigns in a Box, we shared a great deal of information about how Allyson Havener, VP of Marketing at TrustRadius, used research campaigns to identify and target specific new audiences.

We pooled the expertise of Allyson Havener; Brenda Caine, VP of Content Strategy at Content4Demand; and Alexis Carroll, Content Strategist at Content4Demand in a discussion of the three unique research reports Allyson spearheaded.

One in particular uncovered new research on the gap between how tech buyers want to buy software and how businesses sell software. Allyson led this research project to help expand TrustRadius’ audience and establish them as a thought leader on buyer behavior.

According to data from the Content Preferences Report 2022 from Demand Gen Report, today’s buyers rank research and survey reports as the most valuable sources for researching B2B purchases.

Understanding how TrustRadius approached these projects can uncover some helpful insights when you’re considering embarking on your own research campaigns. Following is an abbreviated discussion from the webinar.

To lay some groundwork, we sometimes call a research project a “campaign in a box.” Could you explain why?

Alexis Carroll, Content Strategist, Content4Demand:

Not only does a research report help establish you as a thought leader in a particular space, but it is an asset that no one else will have. You can gate that asset to generate leads and also learn more about your audience with it. Beyond that, the “campaign in a box” piece is that you can build out a campaign for the entire year based on this research. The number of deliverables that you generate is really endless.

We recommend this research report as an early-stage asset, especially since so many companies have a hard time finding the type of thought leadership piece that will be sticky for their audience.

What's the process when you're getting started? How do you develop the survey questions to get to the data that you're looking for?

Allyson Havener, VP of Marketing, TrustRadius:

You have to think about your company, your overall positioning, your messaging and what’s your goal with this report? What are you trying to surface? Once you have that you have buy-in from your marketing team and from the executive suite, because these reports are so robust. You’re trying to align yourself with some kind of trend that’s happening in your market.

You need a clear hypothesis of what you’re trying to prove, disprove, etc.

Have clear goal-setting for what you’re trying to accomplish with this report and what you’re trying to uncover with your survey with your data.

TrustRadius is in a really unique spot. We have a huge buyer community. We have over 12 million buyers who come to our site annually, and they’re doing tons of research.

We have this proprietary audience that we can survey and understand how they want to buy software, how they want to interact with the vendor. This gave us this amazing pool of people to reach out to and understand what they want when they go to buy software.

The other unique piece that we have is an internal research team. Not a lot of marketing teams can say that. I was lucky enough to partner with our VP of Research and think about, again, what are our hypotheses? How do we ask questions to either prove or disprove what we think is happening in the market?

She comes with that kind of expert lens. We partnered with the Content4 Demand team to make sure that we’re crafting these in a way that we can then build a story, because if you think about the story that you’re trying to tell, you want to back into those questions. You’re getting the actual data points that are going to help build that narrative.

There are a lot of moving pieces there, but again, it comes back to, What are you trying to tell the market? What are you trying to either prove or disprove? Build the survey questions. It was really great having an agency that has experience taking that survey and turning it into an actual narrative.

Alexis Carroll:

It can’t be overstated that the investment you make on the front end with these research reports [is so important], because the quality of your questions is going to impact participation. We see people drop off if you ask too many questions. And you want to make sure that you have really good data. Have you asked questions in a way that is going to deliver the answers you need to make some analysis?

I like to think of it like, if you ever paint your living room and you don’t put down a dropcloth and tape it off, you’ll never do that again. Having a partner that has the experience of painting a few living rooms is a huge boon as well.

Who interprets and analyzes the data, how involved did you get in that process and how do you ensure that the data is valid?

Allyson Havener:

One of the things that we did is sliced and diced it in different ways. Essentially, we looked at buyers that are coming from the enterprise versus mid-market and SMB. You can start to see these trends.

The other thing is, you want to start seeing trends over time. We’ll have some examples later. One of the things that we did is we had a baseline. We’re also lucky that we can look at data and trends over time that helps validate it.

But if you’re just getting started, think about the longevity of the report, because you want to do that annually. That was something that really helped us with that validity. It’s just not “one and done,” but you should think about looking ahead and trends that you want to see that happened over time, because that will just build the credibility of the report as well.

For this particular year, this is the first time that we’ve ever used an agency. It was great to have a new perspective, because you get in your echo chamber. It’s nice to get that outward perspective to help you expand what you were already thinking about, and start looking at the data in different ways—like I said, slicing and dicing it based on the type of company, the titles. That helps bring a lot of dynamics to your data.

Again, going back to that story. If you see that the data holds true, no matter how you slice and dice it based on different segments, that’s when you know have a really, really solid argument and you have a really solid trend that you’re seeing. Partnering with Content4Demand [helped break us out of] our echo chamber. You want to get away from any bias that you might already have. It’s nice to have somebody that’s outside looking in.

Alexis Carroll:

In addition to perspective, having real collaboration matters. It always gets you better content to have collaborators, but especially in this particular case, when you’re looking at data. It can become easy to get bogged down in it. Having multiple people at the table with different perspectives—I think that that’s what gives you a really full report and story that you can tell your customers with that information.

Is the way you present the data important? How do you make it easy for your target audience to consume and understand it?

Allyson Havener:

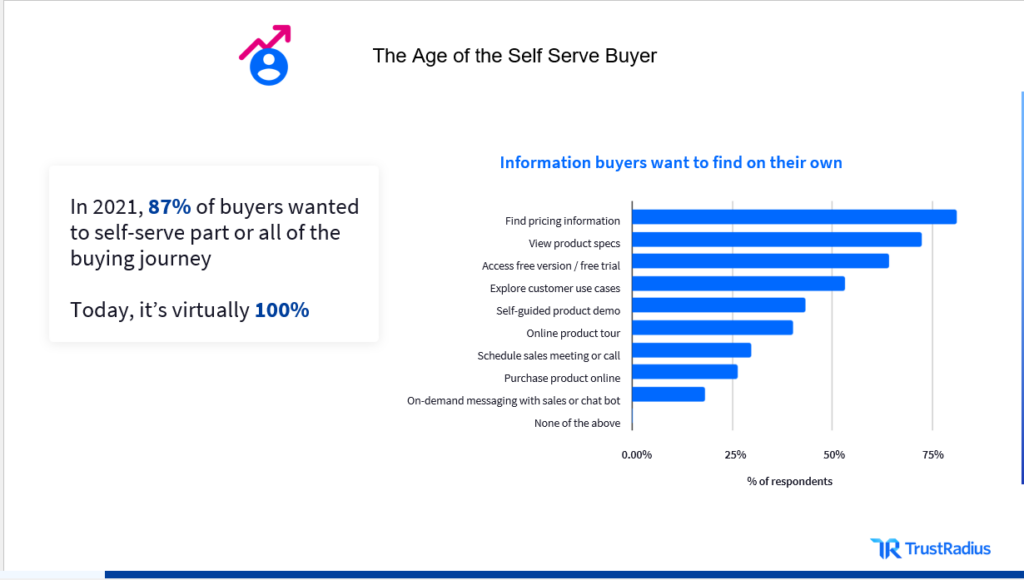

I can share some examples of some of our data. Take our “B2B Buying Disconnect.” This was the report that we built together. We pulled out one macro trend. This was something that we wanted to have, this core theme.

The way we see it nowadays based on all the data is that buyers want to self-serve. They want all the product information up front. They want to control their journey. Most B2B buyers are Millennials or Gen Z. They’re used to being in the digital realm, and that’s how they want to interact with other software providers.

The way we started to present the data is we started to think about, “Okay, we’re in this age of the self-serve buyer. What is the data that supports that?” Well, here’s all this information that they want up front. This is what helps them make a decision.

You have to not just show the data, but what is the story behind it? What is this telling us? You’re pulling those insights from the data and doing it in a way that they can look at it, and it’s really supporting your theory or whatever that narrative is.

We’re really lucky, because we have data over time with the same TrustRadius audience. But you can still do that if you don’t have a proprietary audience. For our next report that’s coming out, we partnered with a company that helps survey a particular audience. We look at trends over time and call out, “Hey, we’re seeing a decline in this resource that buyers care about.”

We also call out these specific things that we’re seeing in the data that help people digest it. A bunch of people don’t want to look at charts. They want to read a story. The data just has to support that story.

Alexis Carroll:

One of the brilliant things about the TrustRadius reports is that there’s a narrative, there’s interesting data, and then you have both the text and the graphs. When you’re reinforcing messaging through different modes, you’re able to reach a much broader audience and make your points more firm and memorable.

We also do interactive pieces so that the user is driving their own experience of the report. There are so many ways that you can do this. A lot of it depends on, do you have a bunch of Millennials as your audience? Since we’ve learned that they’re the majority now making decisions, things like that will be part of your preparation but then can feed into the way that you actually decide to present the information once you’ve gotten it together.

Brenda Caine, VP of Marketing, Content4Demand:

I want to emphasize something I think is so important: TrustRadius does this survey every year. You can start to see trends over time. This is such a great resource that people can come back to year after year to see how things are changing, to see what’s new, to see how they have to adapt and change their business in order to keep up with the trends. Your story then becomes a multi-year story.

We don’t want people to go into it and think, “I’m just going to do a research report and we’re going to do it this year and we’re done.” You can do this every single year and just update it and see what’s really happening in the market.

Allyson Havener:

When you think about that kind of “campaign in a box,” this is just really that the precursor to a whole content strategy. When we think about the self-serve buyer, the underpinnings are a Trust Radius solution.

We’re essentially alluding to this macro trend and how B2B marketers should be thinking about that. Then in our campaigns, we talk about how you address it and how you think about going to market when buyers want to self-serve, when most of them are Millennials, when most of them don’t want to talk to your salespeople. We talk about these high-level solutions and really educate the market on that.

You have that more bottom-funnel content where the solution is, “Hey, TrustRadius supports that.” You can have a whole profile on TrustRadius. You can add your pricing. You can add product demos. You can have a CTA link so they can book a meeting right away and make it completely self-service for them to get in touch with you.

You can see that story arc that you’re creating, but it starts with the research report. It’s rooted in data. You’re inserting this problem for people where they’re like, “Oh, I really need to think about how I go to market so I enable the buyer to want to buy from me. How do I do that?” We lead them down this story arc and then eventually it all ladders into TrustRadius and what we stand for.

The report’s really just the beginning of it. This is feeding our campaigns. This is something that we’re always touching on. We use it in our BDR research, our outreach, we use it in our website. This is just really foundational, but any good content marketer knows that one piece of content should be 10 pieces of content. When you think about that “campaign in a box,” that report is that anchor, anchoring your whole story arc that you create with the rest of your marketing campaigns and assets.

In next week’s blog post, we’ll recap the second half of the conversation, when Allyson describes all the ways she used her research reports not only in demand-gen campaigns, but as an integrated marketing strategy that went from public relations down to bottom-of-the-funnel content.

Watch the webinar for the full discussion and to see examples of TrustRadius’ research reports and why they worked so well.

Holly Celeste Fisk

Holly Celeste Fisk is an accomplished marketing pro with 20+ years of experience in B2B and B2C. She’s responsible for Content4Demand’s internal marketing efforts, managing everything from content creation and email marketing to events and sponsorships, blog publishing, website management and social media presence. When she’s not working, you’ll find her sliding into third at softball, buried in a book or practicing her Italian.